Associated Alcohol & Breweries Ltd.

Associated Alcohols & Breweries Ltd.

Equity

Research Report

CMP : 245 Target Price: 359 Recommendation : Buy

• Associated Alcohol and Breweries Ltd. (AABL) was founded by the Late Shri Bhagwat Prasad Kedia in 1989.

• It is run today under the stewardship of his two sons, Mr. Anand Kedia and Mr. Prasann Kedia.

• The Company’s state-of-the-art manufacturing facility is located at Khodigram (Barwaha district, Khargone, Madhya Pradesh) and responsible for alcohol production, bottling and packaging liquor. All Business operations are overseen from the corporate office in indore.

• The company manufactures premium Extra Neutral Alcohol (ENA) / Triple distilled / Rectified spirit, IMIL and IMFL.

• AABL has diversified business segments, from manufacturing and supply of ENA to contract manufacturing for Diageo-USL, to manufacturing and marketing of licensed brands, as well as Indian Made Indian Liquor (IMIL) and 6 Indian Made Foreign Liquor (IMFL) brands.

• The Company has undertaken expansion initiative to address the growing need of domestic and international customers. The Company possesses an expanded capacity of 45 mn Litres per annum.

• Company Credit Rating CARE reaffirmed its it’s A-/A2 credit rating on the Company for bank borrowing.

|

Ratio Analysis |

2016 |

2017 |

2018 |

2019 |

2020 |

|

|

Revenue |

28764 |

29131 |

33099 |

41158 |

53500 |

|

|

Gross Margin % |

45% |

44% |

51% |

50% |

49% |

|

|

Operating Margin |

10% |

10% |

12% |

11% |

12% |

|

|

Net Profit Margin |

5% |

6% |

8% |

7% |

9% |

|

|

EPS Growth |

5.62 |

6.47 |

9.40 |

11.51 |

19.27 |

|

|

Debt/Equity |

0.40 |

0.25 |

0.12 |

0.15 |

0.04 |

|

|

ROE (%) |

18% |

17% |

21% |

20% |

25% |

|

|

ROCE (%) |

25% |

25% |

30% |

27% |

30% |

|

|

ROA (%) |

9% |

10% |

12% |

12% |

18% |

|

|

Inventory Days |

66.45 |

63.63 |

85.83 |

99.36 |

76.34 |

|

|

Debtors Days |

14.19 |

21.96 |

20.83 |

27.23 |

26.59 |

|

|

Payable Days |

50.86 |

37.41 |

44.13 |

54.32 |

48.56 |

|

|

Cash Conversion Cycle |

29.77 |

48.18 |

62.53 |

72.27 |

54.36 |

|

Proprietary Business

• The company plans to steadily increase its

geographical presence to more states by investing in market building, achieve

critical mass and scale through progressive resource deployment.

• The company’s clear strategy and focus is to

strengthen the proprietary brands contribution to drive profitability over the

coming years.

• All brands are available in all SKU sizes of

750ml, 375ml and 180ml.

Brand Name

James McGill Whisky , Central Province Whiskey, Jamaican Magic Rum, Bombay Special Series, Titanium Triple Distilled Vodka, Apple & Orange Titanium Triple Distilled Vodka.

Licensed / Franchised Brands

• In 2017, AABL enhanced this relationship by entering

into an exclusive franchise agreement with Diageo-USL to distill, blend, bottle

and market some of its key brands in the state of Madhya Pradesh.

• AABL has been accredited as being the best

franchise performers from Diageo, and hence both companies are exploring

options to enhance the franchisee to other states as well.

Contract Manufacturing

Industry

Overview

• India is the third-largest and fastest growing liquor market in the world.

• The India alcohol market was valued at INR 2,807,236.7 bn in 2018,and is expected to reach INR 5,482,851.3 bn by the end of 2027 exhibiting a CAGR of 7.8% for the forecast period (2019-2027).

The ENA Market in India

• According to IMARC Group’s report, the Extra

Neutral alcohol (ENA) market in India reached a volume of 2.96 bn litres in 2019.

•In India, almost 90% of ENA isused for potable

alcohol, which accounts for an annual production capacity of nearly 2.7 bn litres.

The IMFL Market In India

• IMFL volumes are expected to reach INR 339 mn

cases in CY 2022.

• Its consumption in India is expected to post a CAGR of 8.4% in value terms and 4.7% in volume terms in 2017-21.

Market Opportunities

• Rising demand for premium and high prices

alcohol due to increasing purchasing power.

• The rising trend of accepting alcohol

drinking.

• Increasing the number of pubs and bar around

the globe.

• Increasing launches

of flavored alcohol by market players.

• Online liquor sales have increased during

COVID.

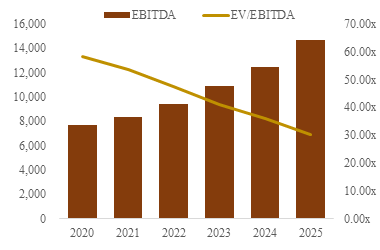

Valuation

Analysis

|

Valuation |

|

2018 |

2019 |

2020 |

2021E |

2022E |

2023E |

2024E |

2025E |

|

Revenue |

33099 |

41158 |

53500 |

58850 |

65912 |

75140 |

87162 |

102851 |

|

|

EBIT |

4019 |

4534 |

6252 |

6992 |

7909 |

9127 |

10455 |

12356 |

|

|

Tax |

1451 |

1634 |

1411 |

2387 |

2637 |

2961 |

3315 |

3810 |

|

|

NOPAT |

2568 |

2900 |

4841 |

4604 |

5272 |

6166 |

7140 |

8545 |

|

|

Add: Dep |

1132 |

1229 |

1410 |

1332 |

1534 |

1747 |

1968 |

2355 |

|

|

Less:Capex |

1599 |

3401 |

1753 |

2751 |

3263 |

3907 |

4596 |

4808 |

|

|

Change in WC |

-810 |

-1867 |

-378 |

-230 |

-1294 |

-1233 |

-1423 |

-1457 |

|

|

FCFF |

2911 |

2595 |

4876 |

3415 |

4836 |

5240 |

5936 |

7550 |

|

Associated Alcohols & Breweries Ltd.

Reported a top line growth of 30% in FY20 over the previous year and has achieved a turnover of ₹53499.91

lakhs in the current year against ₹41158.18 lakhs in the previous year,

the increase in revenue can be majorly attributed to the higher production

achieved on expanded capacity further contribution of IMFL sales and sale of

Extra Neutral Alcohol.

FY20 Earnings Before Interest Depreciation & Tax (EBIDTA) for the year stood at ₹7989.56 lakhs, an increase of 29.20% from ₹6184.25 lakhs in the previous year. FY20 Operating Profit Before Tax (PBT) stood at ₹6371.66 lakhs an increase on 34.66% from ₹4731.66 lakhs in the previous year & the net profit for the year was ₹4933.62 lakhs as against ₹3026.39 lakhs an increase of about 63.01% from the previous year.

AABL’s Net Sales grew in FY20 by 30% and company’s 5Years CAGR is 13.21% during FY2016-FY2020 where as India Alcohols Industry grow at a CAGR of 7.4%.

Global Pandemic & Impact of Covid-19 developed rapidly into a global crisis, forcing governments to enforce lockdowns of all economic activity. All of this situation impact on company’s FY21 growth rate. Covid-19 Impact see in FY21 Q1 result company reported net sale ₹6,037.31 Lakhs and same Q1 ₹13,121 Lakhs in previous year and Net Profit ₹476.91 Lakhs an decrease by 59% from previous year.

Future Growth Strategy

• Expansion plans to cater to the growing needs of the existing domestic and international customers, as well as enhance the company’s presence in all segments of the alcohol consumption value chain by increasing focus on value added high margin products.

• Expansion of capacity from 45 MLPA to 90 MLPA along with cogeneration power plant making AABL the largest single location distillery in India, with a total capex outlay of INR 1,200 Mn.

• Funding of Expansion primarily through internal accruals, helping the balance sheet stay deleveraged.

• Strategy to utilize additional ENA production in to value added products.

• Increase presence of proprietary brands in other major markets of the country.

• Creation of spirit malt manufacturing and storage capacity.

• The company has a low gestation period, ability to achieve 100% utilization level in 6 months post expansion with ample demand scenario.

|

Enterprise Value |

|

|

443058.11 Lakhs |

|

|

Debt |

822 |

|||

|

Cash |

272.11 |

|||

|

Equity Value |

442508 |

|||

|

Share Outstanding |

1808 |

|||

|

Intrinsic Value |

|

|

358.62 |

|

|

Market Price |

245 |

|||

|

Upside Potential |

46% |

|||

We believe AABL’s will grow fastly to increasing demand of

alcohol globally and increase the number of pubs and bars around the globe in

which the company grow fastly to increase in consumption of alcohol.

Company Grow in FY20 by 30% and Net Profit in FY20 increase by 63.01% from the previous year. Company

plans to further enhance their distribution reach to other states in the coming

years it is growth opportunity to Associated Alcohols and Breweries Ltd.

A BUY position is recommended for this

company with a target price of ₹359 per share using DCF valuation.

Share Price 2016-2020 (BSE)

Note :

This Report is only for Education

Purpose only & Should not be used for investment & any other Reason.

Date

: 05 Nov 2020

Analyst

: Mukul Kumar

Comments

Post a Comment