Exide Industries Ltd.

EXIDE

INDUSTRIES LTD.

About of Company

Exide

Industries Limited is an Indian storage battery producing company and a life

insurance company headquartered in Kolkata, India. It is the largest

manufacturer of automotive and industrial lead-acid batteries in India and

fourth largest in the world. It has plants in India and Sri Lanka and

dealership network in 46 countries spanning across 5 continents. Exide also has

four major lead-acid battery recycling facilities — two of which are in the

United States, and Spain and Portugal each have one as well. The company claims

that 99 percent of lead processed through these facilities is recycled.

Key application areas

Automotive

Company are the market leader in all automotive applications in the domestic market. Company’s portfolio spans batteries for four-wheelers, two-wheelers, three-wheelers, e-rickshaws, inverters, gensets and home UPS systems. Brand Exide, SF Sonic and Dynex spearhead our domestic presence, while brands Dynex, Index and SF Sonic cater to the international market.

Capacity Range 3 AH TO 200 AH

Industrial

They provide reliable energy storage solutions to all industrial applications: power, solar, railways, telecom, UPS, projects and traction, among others. Our domestic industrial battery brands are Exide, SF and CEIL; while the flagship brands in the overseas market are Exide, CEIL, Chloride and Index.

Capacity Range 7 AH TO 3,200 AH

Submarine

The only

company in South Asia with the capability of bulk manufacturing of high-end

batteries for different classes of submarines, such as German, Russian and

French, along with nuclear submarines. Company are the sole supplier to the

Indian Navy for more than three decades. Company is also export to other

countries with permission from the Government of India. Batteries used in

submarines are highly critical and specialized in nature, being the singular

source of power in the warships.

Capacity Range 20,000AH

• Manufacturing

9 plants

at strategic locations in India with a production capacity of 57 million units

of automotive power and 5 billion Ah of industrial power.

• R&D Prowess

90+ engineers and technology experts.

• Technology

Collaborators

Moura Batteries, Brazil; Furukawa Battery Company, Japan;

East Penn Manufacturing, USA; Advanced Battery Concepts, USA; and Hitachi

Chemicals Co., Japan, among others.

• Distributions Network

150+ warehouses and sales offices and 48,000 direct & indirect dealers

170 service centers

170+ Batmobile vehicles

100+ Humsafar vehicles

1,300+ service technicians

12 inverter repair centers

• Global Footprint

50+ export destinations

Exide, Leclanché and Tata Power jointly worked and collaborated to advance a R&D pilot community Battery Energy Storage System (BESS) project, which included an initial installation and operation of a grid-connected BESS. This BESS uses lithium-Ion batteries and has a power rating of 150kW with a nameplate capacity of 528 kWh that is mounted in a 20-feet container on site at a substation of Tata Power in New Delhi.

Key Market Trend

• The India battery market is already making sustained gains and is expected to flourish in the global market over the forecast period with the rise in electric vehicle sales coupled with increasing solar PV installations in the country, which in turn, likely to drive the market.

• Electric vehicles (EVs) are expected to play a central role in attaining sustainable development goals. In India, the adoption of EV is likely to grow significantly with the increasing demand for clean energy sources. The government has plans to achieve a target of 30% electric vehicle adoption by 2030 powered primarily by electrification of two-wheeler, three-wheeler, and commercial vehicles in India.

Some of the Major

Launches of 2019-2020 and Upcoming Launches where Exide has 100% share

New OEMs in India such as Morris Garages and Kia Motors have relied on Exide Batteries.

Hyundai launching Venue their first

offering of connected Vehicle in India.

Financial Performance

Exide

Industries Ltd. reported in FY20 Revenue decline by 7% over the previous year.

Company has reported Net Turnover in FY20 of Rs. 9,857 crores as compared to

Rs. 10,588 crores reported in FY19.

FY20

Earnings Before Interest Depreciation & Tax (EBIDTA) for the year stood at Rs.

1,428.92 crores, an decrease of 1% from Rs. 1,449.84 crores in the previous

year. FY20 Operating Profit Before Tax (PBT) stood at Rs. 1,035.2 crores an decrease

on 16% from Rs. 1,130.3 crores in the previous year & the net profit for

the year was Rs. 825.5 crores as against Rs. 844.1 crores an decrease of about 2%

from the previous year.

Exide

industries Ltd. Net sales decline by 7% because of the Slowdown in the

Automotive production and domestic sales, Exide is being a major OE supplier

has also been affected.

Global

Pandemic & Impact of Covid-19 developed rapidly into a global crisis,

forcing governments to enforce lockdowns of all economic activity. All of this

situation impact on company’s FY21 growth rate. Covid-19 Impact see in FY21 Q1

result company reported Net Sale Rs. 1,547.62 crores as compared to Rs.

2,779.25 crores an decline by 44%.

COVID-19

pandemic and the consequent lockdowns to curb its spread caused severe

disruption in manufacturing, supply chain, and sales & distribution

operations of the Company. This has caused an adverse impact on its sales as

well as profitability during the quarter.

Indian

Economy GDP in FY21 Q2 is contracted 7.5%. This was a good improvement to compare to FY21 Q1is contracted 23.9 %. While this is a positive

sign.

RBI predicts Indian economy has stopped shrinking in the

October-December quarter projecting a GDP growth of 0.1 per cent in Q3 and 0.7

per cent in Q4 January-March of 2021.

The company is also

comes with goods number in Q2 FY21 company reported net turnover of Rs.

2753.38 crores as compared to same quarter FY19 is Rs. 2610.86 crores.

Exide Industries Ltd. reported Net Turnover for the Q3 FY21

of Rs. 2,801 crores as compared to Rs. 2,411 crores during the Q3 FY19. Profit

Before Tax (PBT) was Rs. 320.03 crores as compared to Rs. 250.27 crores during

the Q3 FY19, an increase of 28%. Profit After Tax Q3 FY21 of Rs. 241.44 crores

as compared to Rs. 195.93 crores during the Q3 FY19.

Company CEO, said that while after market volume for both Automotive and UPS batteries remain encouraging , demands in OEM and other infrastructure segments also started showing some positive indications during the quarter.

Analyst View

We believe

that Exide Industries will grew fastly to increase in demand clean energy sources. The government has plans to achieve

a target of 30% electric vehicle adoption by 2030. Increase in demand of EV

vehicle and growing solar PV installations in the country. which in turn, likely to drive the market.

Company

reported in FY20 Revenue decline by 7% over the previous year. Company has

reported Net Turnover in FY20 of Rs. 9,857 crores as compared to Rs. 10,588

crores reported in FY19. The decline in net sale in 7% because of the Slowdown

in the Automotive production, domestic sales and global pandemic. Company is a

major OE supplier has also been affected. We expected that company will going

good in future.

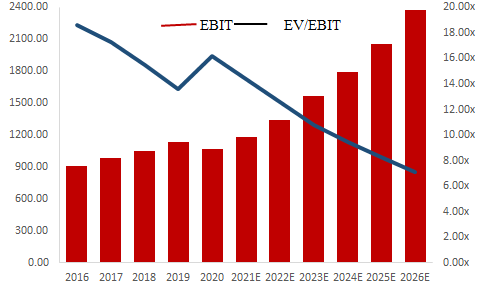

We

expected that company to grow at a 15% during the forecast period of 2021-2026.

Forecast Net Turnover estimate in FY21of Rs. 11,070.01 crores.

FY21 EBITDA

estimate of Rs. 1,541.36 crores.

FY21

Profit Before Tax estimate of Rs. 1,174.8 crores.

FY21Net

Profit estimate of Rs. 838.2 crores.

A Buy position is recommended for this company

with a target price of Rs. 300 per share for mid term. Long term target of Rs.

400 per share.

Share

Price 2000 – 2026 (NSE)

Historical Price Forecast Price

Note :

This Report is only for Education Purpose only & Should not be

used for investment & any other Reason.

Date : 02 Feb 2021

Analyst : Mukul Kumar

Comments

Post a Comment